Indian recycling industry

Sunrise potential in the Indian recycling industry, led by a growing focus on circular economy and decarbonization, favorable economics and an evolving regulatory framework.

The Indian recycling industry is yet to achieve maturity and is dominated by unorganized players, leading to substantially lower recycling rates compared to the West. Government policies are gradually addressing these challenges. The Battery Waste Management Rules, 2022, is one such landmark policy that should benefit organized lead recyclers such as GRAV. The prospects for plastic and e-waste recycling also appears promising but require further policy support.

Government policies reflect strong intent to scale up and formalize recycling industry: Recycling rate in India (~20%) is significantly lower than the West (60-80%) due to a large informal sector, the lack of a policy framework and inadequate collection infrastructure. We see a gradual evolution in the regulatory framework, with policies focused on enhancing the circular economy. The Battery Waste Management Rules (BWMR), 2022, are one such major stride. The BWMR imposes Extended Producer Responsibility (EPR) on battery producers, holding them accountable for the collection, recycling and use of recycled materials in new batteries. This should significantly increase lead scrap availability for organized players and shrink the unorganized sector over the next 3-5 years.

Recycling industry prospects across different commodities—Lead (Pb) tops the chart

Lead recycling―on the brink of rapid formalization: Lead is one of the most recycled metals in the world; secondary lead contributed to 80%+ of total lead production in India in CY2022. This is due to: 1) infinite recyclability, 2) lower extraction and capex costs (versus primary lead) and 3) 95%+ recyclability of a single LAB. Domestic lead recycling has hitherto been largely informal (~65% in FY2023), but we expect policy tailwinds such as BWMR to reduce unorganized market share to below 10% by FY2033E. LABs are the most common end-use for lead, and the automotive sector is the largest end-use for LABs. This exposes LABs to the risk of obsolescence from EVs, where li-ion batteries are most commonly used for motive power. We believe the threat of declining LAB market size is overblown, and estimate LAB market growth for at least another decade.

Plastics - Environmental aspects to act as an enabler: Concerns about plastic waste have dominated public discourse on plastic use/substitution; we see the Plastic Waste Management Rules 2022 (PWM), notified in 2022 as the first step to improve traceability in the plastics ecosystem. Like BWMR, the focus is on EPR, wherein the producers, importers and brand-owners (PIBOs) are responsible for environmentally sound management of plastic waste; however, regulatory enforcement is still weak. Plastics undergo change in chemical, thermal and impact resistance properties when recycled – unlike metals. The domestic ecosystem for plastic recycling is yet to mature due to: 1) issues pertaining to the collection of plastic (other than rigid/category 1 plastics), 2) sorting of complex plastic types and 3) concerns about recycled plastics’ properties versus virgin plastics. We believe that this poses an incentivization problem—compliance with the PWM rules will be a function of enforcement, and we expect it to pick up meaningfully only in the medium to long term.

Aluminum recycling industry―Secondary aluminum growth outperforming primary: Indian aluminum demand in FY2023 stood around 4.5 mn tons, of which ~40% was recycled/secondary aluminum. Secondary aluminum growth has outpaced primary aluminum growth in the past 7-8 years, and is preferred by auto OEMs, owing to cost benefits, including the presence of alloy materials in the scrap. Advantages of secondary aluminum include: 1) lower capex cost 2) 90- 95% lower production costs and 3) better ESG metrics. The lack of domestic scrap availability is a headwind; however, we expect it to be mitigated, in line with India’s economic development and institutionalization of scrap collection value chain in the coming years.

Lithium-ion Battery (LIB) Recycling—Yet to take off: The global EV battery recycling industry is yet to take off, in line with the shift to EVs. These batteries typically enter recycling after 8-10 years, and the first global batch of batteries is expected to hit the recycling market by around 2030. However, recycling value chains for LIBs are far from established. The key reasons for this include: 1) volatile battery material prices, 2) concentration of key metals used in current generation of batteries and 3) continuously changing battery chemistries. Indian players lag international peers due to a lack of established technologies, but we expect this gap to be bridged as the overall ecosystem matures. \

E-Waste: Scrap availability is increasing at a rapid pace; however, the lack of technology and presence of hazardous materials are key hurdles restricting growth.

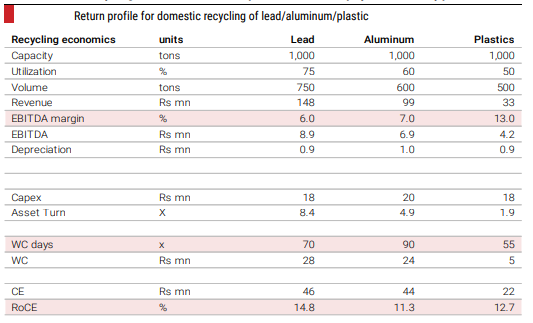

Return profile: Lead recycling currently enjoys better returns followed by plastics and aluminum

Lead recycling to have the most attractive return profile versus peers such as plastics and aluminum. The return on capital employed (RoCE) for all recycling of a commodity is a function of both upfront capex and working capital requirements. In this context, the lower domestic scrap availability of aluminum leads to lower RoCEs on account of higher working capital due to scrap imports. On the other hand, while domestic plastic waste is more readily available, it often requires significant processing, given the complexities of its composition. Based on our understanding, most plastic recyclers streamline procurement of particular plastic types on the basis their processing capabilities. This limits the availability, and consequently the utilizations achieved, impacting return ratios for the sector.

Companies in recycling sector in India

Gravita India (GRAV IN): GRAV is a market leader in India’s emerging recycling industry, where the key business segment, lead recycling, enjoys significant tailwinds. Its expansion plans in other segments give strong visibility on growth and diversification. Peers such as POCL, NILE and Pilot in lead recycling lack geographic diversification, have lower operating margins and offer lower growth visibility. We forecast GRAV’s revenue/PAT CAGR at 20%/22% for the next three years, with 20%+ ROCE and see potential for multi-year compounding growth.

Pondy Oxides and Chemicals (POCL IN): POCL is the second-largest listed lead recycling company with a recycling capacity of 120,000 TPA, along with smaller capacities in segments such as aluminum and plastics. Its manufacturing facilities are located in South India (TN and AP). Its EBITDA margins have been in the range of 2-6% during FY2018-23. The company plans to focus on organic lead segment capacity expansions, and expects 10%+ sectoral growth for organized players after the implementation of BWMR. Management does not plan to set up overseas plants, and will focus on Indian operations given the policy tailwinds.

NILE (NL IN): NILE has two secondary lead recycling plants in the South region, with an aggregate capacity of 109,000 TPA. EBITDA margins have been in the range of 3-7% during FY2018-23; however, there is customer concentration risk―almost 100% of NILE revenues are derived from Amara Raja Group, which has its plant in the Southern region. NILE is actively looking at alternate customers for the sale of lead and lead alloys. It has also set up a wholly owned subsidiary for R&D and pilot plant pertaining to the recycling of li-ion batteries.

Pilot Industries (unlisted): PIL is engaged in the manufacturing of lead alloys and LABs under the brand name “Leader”. The company has two manufacturing facilities in the North region with an aggregate smelting capacity of 79,200 TPA, along with LAB capacity of 0.6 mn units. PIL has increased revenue contribution from the battery segment to 32% in FY2022 versus 29%/21% in FY2021/20. Margins for the company have remained in a narrow range of 4.5-6% for FY2020-22. Top5 customers accounted for 61% of total revenue in FY2022 (FY2021: 58%), with top customer Amara Raja accounting for 31% of the company’s revenues. The company does not have any capital market exposure and relies on banks and financial institutions to meet its funding requirements.

Ganesha Ecosphere (GNPL IN): GNPL is primarily engaged in the manufacture of recycled polyester staple fiber (RPSF) and yarn. As of CY2022, its production facilities are located in Kanpur (Uttar Pradesh), Rudrapur (Uttarakhand) and Bilaspur (Chhattisgarh). Additional production facilities in Warangal and Nepal have been added in CY2023 via wholly owned subsidiaries. Margins have been in the range of 10-12% in FY2018-23. GNPL is transitioning from mainly an RPSF player to a solutions provider in the rPET ecosystem; it plans to put two more rPET production lines in existing Warangal facility, which are expected to be operational in phases in the next 6-8 months.

Newsletter #12

Know more about us on https://valuesense.in/

We are a SEBI Registered Research Analyst firm and provide the following subscription service for the Indian Equity Markets. https://valuesense.in/product/alpha/

-Equity Advisory Service (8-10 Stock Recommendations every year).

-Regular updates on the recommended stocks.

-Book reviews.

-IPO reviews.

-Special Situation Opportunities wherein demergers and buybacks can unlock value in 3-6 months.

-Stock Synopsis reports.

-Weekly Newsletter.

-Research Report on Demand.